child tax credit 2021 eligibility

However if the IRS paid you too much in monthly payments last year ie more than the child tax credit youre entitled to claim for 2021 you might have to pay back some of. How much is the child tax credit worth.

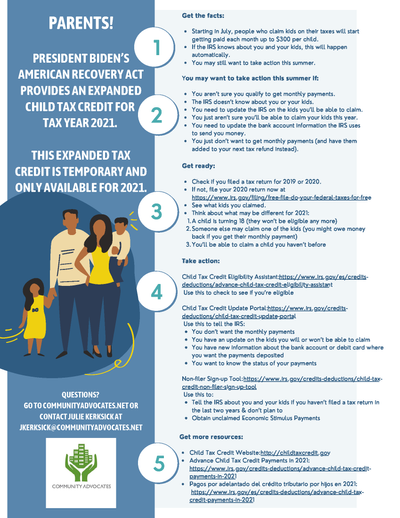

Child Tax Credit What We Do Community Advocates

The phase-out threshold was increased from 75000 to 200000.

. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying. Your amount changes based on the age of your children.

3600 for children ages 5 and under at the end of 2021. That amounts to 300 per month. Advance Child Tax Credit Eligibility Assistant.

Half of the money -- up to 300 per month per child -- was distributed to eligible families who didnt opt out using the IRS Child Tax Credit Portal in 2021. In previous years 17-year-olds werent. Ad File 1040ez Free today for a faster refund.

Parents must have an earned income of at least 2500. Ad Free tax support and direct deposit. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

3000 for children ages 6. The American Rescue Plan expanded the child tax credit from 2000 per child taken every year when you file your taxes to 3600 per child with half the amount paid in. The IRS will pay 3600 per child to parents of children up to age five.

Ages five and younger is up to 3600 in total up to. The credit will also be fully. Advance Child Tax Credit Payments in 2021.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 per child for qualifying children under the age of 6 and to 3000 per child for qualifying.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. In the tax year 2021 under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6. Eligible filers will only receive half of the total CTC in the.

All children must possess a Social Security Number. Half will come as six monthly payments and half as a 2021 tax credit. For 2021 eligible parents or guardians can receive up to 3600 for each child.

The maximum amount of payment per month is up to 300 for each child under six and 250 for each child six and older. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. The payment for children.

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Child Tax Credit 2021 8 Things You Need To Know District Capital

2021 Child Tax Credit Advanced Payment Option Tas

How The New Expanded Federal Child Tax Credit Will Work

Child Tax Credit United States Wikipedia

The Big Increase And More Changes To The Child Tax Credit In 2021

Should The Child Tax Credit Be Limited To Those With Lower Incomes As Manchin Prefers

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

Do Child Tax Credit Payments Stop When Child Turns 18

Arpa Expands Tax Credits For Families

Do Child Tax Credit Payments Stop When Child Turns 18

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Did Your Advance Child Tax Credit Payment End Or Change Tas

Here S Who Qualifies For The New 3 000 Child Tax Credit

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

What S The Most I Would Have To Repay The Irs Kff

Child Tax Credit January 2022 When Could Ctc Payments Start In 2022 Marca